HELPING HIGH-NET-WORTH INVESTORS DIVERSIFY, ACCELERATE CAPITAL GROWTH, MITIGATE RISK & PRESERVE WEALTH

THROUGH ALTERNATIVE INVESTMENTS

Income-Producing Real Estate Investment, Alternatives and Portfolio Diversification

Specialization in Income-Producing Real Estate

UPYIELD ALTERNATIVE INVESTMENTS focuses on direct investment opportunities in income-generating real estate assets. By targeting properties that produce consistent revenue streams, the firm aims to deliver attractive returns to investors seeking reliable income sources.

The Role of Alternative Investments in High-Net-Worth Portfolios

For high-net-worth individuals, alternative investments are increasingly recognized as a vital component of a comprehensive investment strategy. While traditional vehicles such as stocks and bonds have long served as effective tools for wealth accumulation, alternative assets offer a valuable layer of diversification, which can help reduce portfolio risk and enhance overall stability.

Profit and Return Potential

Alternative investments, such as direct real estate holdings, present significant profit and return opportunities for investors with substantial means. By incorporating these assets into their portfolios, well-heeled investors may benefit from both increased diversification and the potential for strong financial performance.

Mike Carlson

Founder, President &

Chief Investment Officer

Mike is an expert in wealth management through strategic portfolio construction and investment selection that includes equities, fixed-income vehicles, income-producing investment real estate and alternative investments. Mike has a proven 25+ year record of success in creating wealth for clients using a highly personalized, hands-on approach that has transitioned many investors to high-net-worth status.

Strategic Collaboration

At UPYIELD ALTERNATIVE INVESTMENTS, we collaborate closely with prominent professionals in stock brokerage, wealth management, banking, tax services (including tax planning and optimization), accounting, legal advisory, insurance (risk management), retirement planning, estate and legacy planning (wealth transfer), and charitable giving. Our integrated approach enables our expert team to effectively manage every aspect of wealth administration, ensuring comprehensive solutions for our clients.

Challenges Faced by High-Net-Worth Investors

As a high-net-worth investor, you often find yourself the target of various brokers, each eager to present their offerings. Stockbrokers approach you with the intent to sell stocks, while real estate brokers focus on properties. Beyond these, there are numerous speculative brokers promoting investments such as REIs, gold, opportunity zone shares, art, bitcoin, and business franchises. However, it is important to recognize that brokers are typically driven by the desire to sell their specific products. Their recommendations may not align with your actual financial needs, as their primary motivation is selling what they offer rather than providing truly objective guidance tailored to your situation.

A Distinctive Methodology - Upyields' Unique Value Proposition

UPYIELD ALTERNATIVE INVESTMENTS employs a distinctive methodology. We consider each investment portfolio as an integrated system. Recognizing that every individual is unique, we tailor our approach to meet the specific needs of each investor and their portfolio. Our process begins with a comprehensive assessment of the client's financial objectives, risk tolerance, and market preferences. By analyzing these factors in depth, we create customized strategies that utilize diverse asset classes and alternative investments suited to the client's goals. Regular reviews and adjustments ensure that portfolios remain aligned with evolving market conditions and the investor's changing circumstances, providing a personalized and dynamic solution for long-term growth.

Expert Leadership: Mike Carlson’s Distinctive Approach

Mike Carlson brings a unique combination of expertise, education, and experience to wealth-building strategies. He has broad-based strategic knowledge including expertise in income-property investment, portfolio construction, and investment selection across equities, fixed-income instruments, and alternative investments. With over 25 years of demonstrated success, Mike has assisted numerous clients in achieving high-net-worth status through a personalized, hands-on approach. Clients benefit from direct engagement with Mike himself, rather than being delegated to junior staff. This individual attention, combined with comprehensive investment knowledge, distinguishes him from professionals who focus solely on one investment sector.

Mike’s proficiency in income-generating real estate, investment strategy, and wealth management is supported by studies at leading institutions such as Harvard, NYU, MIT, Columbia, and Wall Street Prep. These skills have been continually refined through consistent, day-to-day successes on behalf of his clients.

Disclaimer: Mike Carlson is not registered as a Registered Investment Adviser (RIA) or an Investment Adviser Representative (IAR). The services offered are limited to consulting and executing strategies related to direct investment in income-producing real estate and do not include fee-based investment advice outside of this scope.

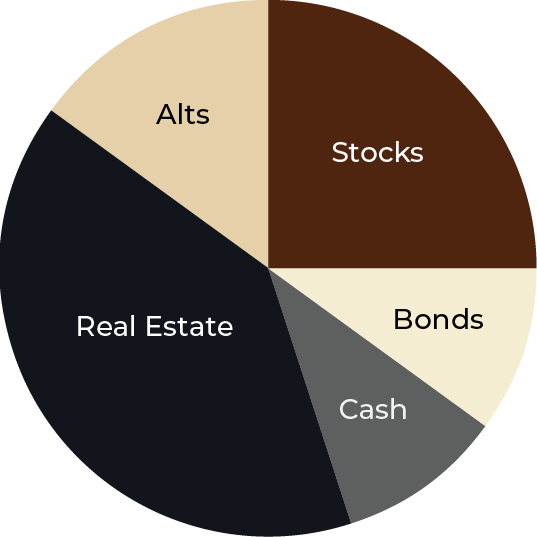

UPYIELD ALTERNATIVE INVESTMENTS will collaborate with you and your other trusted advisers through the process of strategic Asset Class Allocation, Portfolio Construction, Investment Selection and appropriate diversification based on your individual risk tolerance and investment objectives.

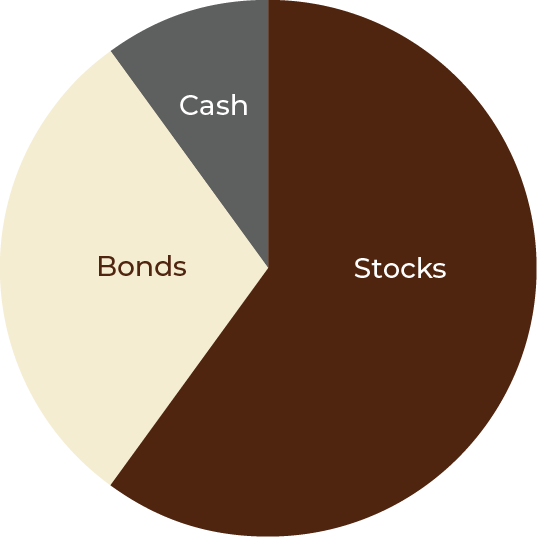

TRADITIONAL

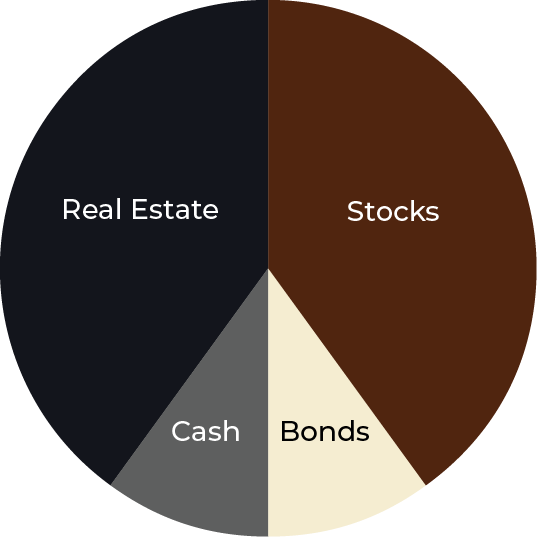

TRADITIONAL +

REAL ESTATE

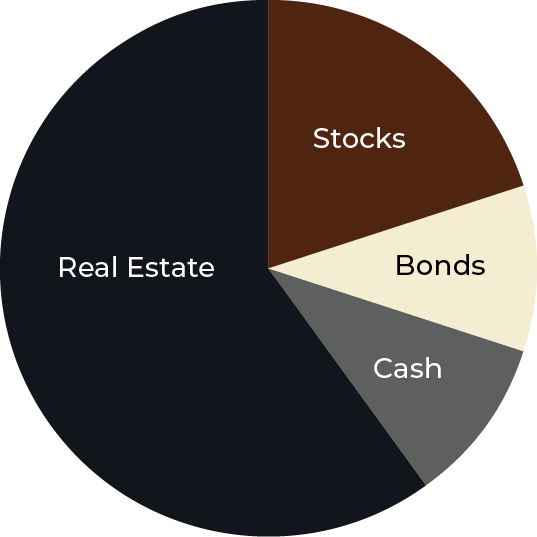

REAL ESTATE

WEIGHTED + TRADITIONAL

HIGH-NET-WORTH

INVESTORS

* Please note that the above asset class allocation pie graphs are only examples and will vary by the investor.

Alternative Investments

Choosing the right investments and proper mix depends upon your goals, risk tolerance, and investment timeline.

Accelerate your wealth growth with Income-Producing Investment Real Estate: The safest and most time-tested alternative investment

Real estate is the most accessible alternative investment—many Americans are already invested in this asset class by owning their homes. Real estate investing means purchasing real property or buying funds that invest in real estate. Real estate investors anticipate appreciation in value over time, while income-producing real estate assets like apartment buildings also generate steady rental income. Real estate is one of the safest ways to build wealth and grow your net worth in the United States. I am referring to positive cash-flowing rental property (not real estate that takes money out of your pocket every month). But a surprising number of high-net-worth individuals are only invested in the stock and bond market.

Some associate real estate with risk or complexity. For many, stocks seem less intimidating and thus an easier path to default to. But the fact is that bear markets emerge every 3.5 years on average – with a corresponding average loss in value of 35% per bear market. Income-producing real estate is a logical hedge against the highly repetitive bear market cycle. It is another vital cylinder you should have firing under the hood of your investment portfolio. Income-producing investment real estate is subject to cycles just as any investment sector is. But it's cycles often run counter to stock market cycles, adding to its value as a protective hedge for your portfolio.

"It is widely documented that approximately 90% of all millionaires gained their wealth through real estate."

Upyield, through our parent company, Realty Yield, focuses exclusively on the alternative investment of income-producing real estate.

To learn more about Realty Yield, our parent company, click the link above.

What Our Clients Say

“My experience as a first-time investment property buyer... I thought the whole process of picking an income property would be easy, especially in a down market. This is not the case. Be ready for a cautious and lengthy endeavor. Mike has been willing to put in the time to analyze and pursue quality properties. His experience is invaluable because what looks good on a cut sheet is not always as it seems. It saves time to use a person like Mike who knows what good prospects look like.”

Clinton L

“We were so pleased with Mike’s handling of our real estate that we referenced Mike as a contact for our children and our attorney if we should die and the children were to be left with the apartments. We knew that Mike would be honorable and not take advantage of them in settling our real estate holdings."

Nira L

“Mike Carlson is great, very professional, experienced, and comfortable to work with. Mike took me, a private investor and calmly, carefully, and completely took me through the entire process: analysis of my portfolio, investment scenarios, identification and purchase of appropriate properties and follow-up management. I would not be where I am without them! It has been over twenty years now."

John B.

Schedule your COMPLIMENTARY CALL

At UPYIELD ALTERNATIVE INVESTMENTS, we help you navigate the complex world of income-producing investment real estate and alternative investments.

Mike Carlson

Founder, President & Chief Investment Officer